The goal of this bill is to harmonise, modernise, and regulate the electronic payment landscape across the Eastern Caribbean Currency Union (ECCU), ensuring consumer protection, financial inclusion, and technological innovation in payment systems.

The basis of this amendment stems from the evolution of commerce and e-commerce, which has led to an increased reliance on non-bank financial service providers, such as PayPal, and cryptocurrencies.

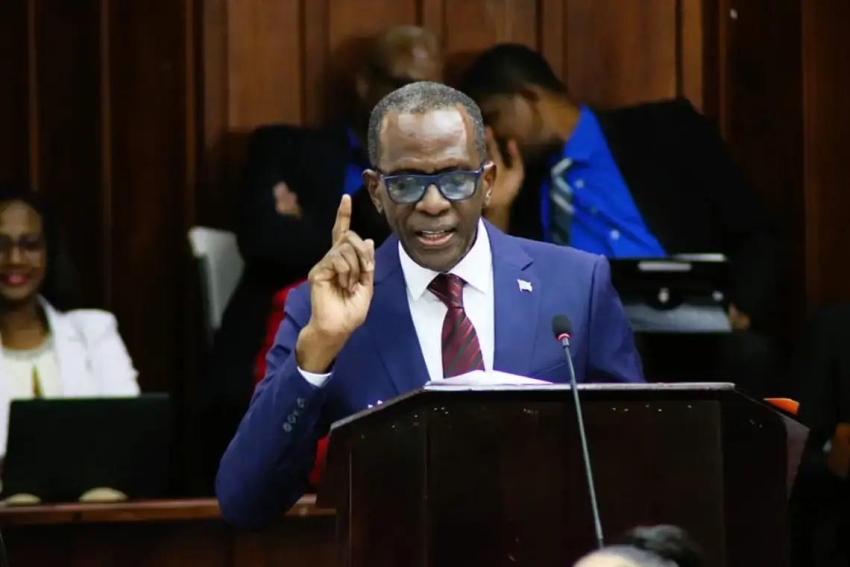

“This bill is integral to the Central Bank’s modernisation agenda. It’s designed to nurture financial inclusion, reduce reliance on cash, and expand access to electronic payment systems,” said Prime Minister Philip J. Pierre, who moved the second reading of the Payment Services Amendment Bill last week.

This legislative agenda is part of the broader Caribbean Digital Transformation Project, spearheaded by the World Bank and the Organisation of Eastern Caribbean States (OECS) Commission from 2021 to 2024.

Pierre added that the Bill underwent several consultations and revisions, including a recall in June 2024 to make provisions for the inclusion of the Office of Financial Conduct and Inclusion (OFCI), which the ECCB has committed to incorporating in future amendments.

Under this updated piece of law, operating a payment system without a valid licence from the ECCB would be an offence, attracting penalties. The Central Bank would also be authorised to impose licence conditions, including those related to electronic money and outsourcing of services.

Licensed entities would be obligated to notify the ECCB of any criminal proceedings, disciplinary action, or material changes to their services. The ECCB would also have the authority to issue directives, conduct audits, and require information necessary for regulatory compliance.

Pierre stressed that a key objective of the bill is to strengthen consumer trust in digital payment systems by ensuring transparency, safety, and accountability.

Sais PM Pierre: “This bill is a mechanism by which consumers are protected. There is a clear process and procedure under which payment systems are managed. This ensures that when consumers use these services, their money is handled securely, and the process is transparent.”

A new Eastern Caribbean Payments Council would be established to advise the ECCB on system oversight. The Bank would be permitted to enter premises, conduct investigations, and commission independent audits when necessary. Strict confidentiality provisions are also included to protect sensitive financial information, with specified exceptions.

“All of this,” Pierre said, “leads to one thing: for the consumer to benefit from a transparent and well-regulated system that ensures their money reaches the right place and is managed properly.”

The goal of this bill is to harmonise, modernise, and regulate the electronic payment landscape across the Eastern Caribbean Currency Union (ECCU), ensuring consumer protection, financial inclusion, and technological innovation in payment systems.

The basis of this amendment stems from the evolution of commerce and e-commerce, which has led to an increased reliance on non-bank financial service providers, such as PayPal, and cryptocurrencies.

“This bill is integral to the Central Bank’s modernisation agenda. It’s designed to nurture financial inclusion, reduce reliance on cash, and expand access to electronic payment systems,” said Prime Minister Philip J. Pierre, who moved the second reading of the Payment Services Amendment Bill last week.

This legislative agenda is part of the broader Caribbean Digital Transformation Project, spearheaded by the World Bank and the Organisation of Eastern Caribbean States (OECS) Commission from 2021 to 2024.

Pierre added that the Bill underwent several consultations and revisions, including a recall in June 2024 to make provisions for the inclusion of the Office of Financial Conduct and Inclusion (OFCI), which the ECCB has committed to incorporating in future amendments.

Under this updated piece of law, operating a payment system without a valid licence from the ECCB would be an offence, attracting penalties. The Central Bank would also be authorised to impose licence conditions, including those related to electronic money and outsourcing of services.

Licensed entities would be obligated to notify the ECCB of any criminal proceedings, disciplinary action, or material changes to their services. The ECCB would also have the authority to issue directives, conduct audits, and require information necessary for regulatory compliance.

Pierre stressed that a key objective of the bill is to strengthen consumer trust in digital payment systems by ensuring transparency, safety, and accountability.

Sais PM Pierre: “This bill is a mechanism by which consumers are protected. There is a clear process and procedure under which payment systems are managed. This ensures that when consumers use these services, their money is handled securely, and the process is transparent.”

A new Eastern Caribbean Payments Council would be established to advise the ECCB on system oversight. The Bank would be permitted to enter premises, conduct investigations, and commission independent audits when necessary. Strict confidentiality provisions are also included to protect sensitive financial information, with specified exceptions.

“All of this,” Pierre said, “leads to one thing: for the consumer to benefit from a transparent and well-regulated system that ensures their money reaches the right place and is managed properly.”