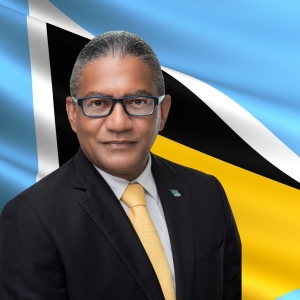

Infrastructure Minister and Former Prime Minister Honourable Stephenson King, at the commencement of his contribution, recalled his time at the helm of the government. King referred to the Security Tax Act (2011), which imposed a 1% tax on the customs value of all imported goods. At the remembered sitting of Parliament on September 13th, 2011, King was recorded by Hansard as asserting, “It is therefore recommended that the security tax bill be enacted to assist government in financing initiatives to heighten security in Saint Lucia and reduce crime”. At the time, King led the ruling United Workers’ Party. Twelve years later, in 2023, he stresses that the current Levy before the House is nothing new to Saint Lucia; that it “has a broader perspective”, as it includes healthcare; and that it would receive his approval.

Comparing the current levy to its apparent predecessor, the Security Tax Act (2011), yields many informative answers. In one instance, the Security Tax Act (2011), under a former UWP administration, only collected revenue for citizen security, while this current Levy will collect revenue for both citizen security and healthcare. In another, the Security Tax Act (2011) imposed the tax on all imported goods, whilst this current Levy has identified 33 categories of items that will not be taxed.

Vocal of his disapproval of the Health and Citizen Security Levy is the Opposition Leader - who was notably absent from the debate on the Bill. An open letter was written from his office to that of the Prime Minister’s, urging Prime Minister Honourable Pierre to “reconsider this ill-conceived decision.” The Opposition Leader claimed the levy will “exacerbate the plights of our more vulnerable households.” The Legislation itself says something quite different.

Schedule 3 of the Legislation lists, in detail, the items exempted from taxation. While the Prime Minister has assured the public that “food and medicine” will not be taxed, other items are also part of that list. According to the Act, “live animals, trees and plants, tea, coffee, oil seeds, grains, sugars and confectionery, fertilizer, mineral oils, soaps, perfumes, essential oils, alloys, chemicals, and plastics” are exempt from the 2.5% Levy. Of note, the Act also lists the items which will be taxed. “Spirits, tobacco, rare-earth metals, precious stones, nuclear reactors, vehicles, and arms and ammunition” are among the items which will be taxed!

Beyond this Levy are also other legislative and policy actions by the Government to prioritize the public. Coming into effect on August 2nd, 2023 is the Value Added Tax (VAT) exemption on construction materials and personal care items. According to the Prime Minister, this move is to “stimulate the construction industry” and “provide relief to women across the island.”. The Prime Minister, however, downplayed the many potential positive benefits of these policies for citizens. The Government has empowered mothers two-fold: by causing a severe reduction in their personal care items and allowing them to build safe living environments for families. Bear in mind that while the reduction on sanitary napkins is small, the emotional consideration is large. Senator Lisa Jawahir, in her presentation to the Senate on July 13th, lamented the fact that some women have to “use cloth because they cannot afford pads!” “Period poverty” is what the occurrence is affectionately known as - the inability of women to either afford or access sanitary napkins. The Government has proven its commitment to equitable gender Legislation; its commitment to the women of Saint Lucia.

The Government has also attempted a head-on attack against the Healthcare issues on-island. The launch of the Universal Health Coverage Programme is incrementally tackling the health deficiencies that society currently faces. On June 1st, the UHC’s first phase was launched. Mothers now have free pre and post-natal services at wellness centers across the island. Additionally, one month later on July 1st, elderly citizens aged 80 and over gained access to free eye and ear services at wellness centers. Systematically, the government remains true to its promise to make healthcare more accessible and affordable for all its citizens.

The Health and Citizen Security Levy, is in spirit and action, more than just the legislation passed in Parliament. It is a collaboration between policy and legislative agenda, benefitting all Saint Lucians. Despite the criticisms brought forward by the Opposition, suitable alternatives have yet to be advanced. Until such time, citizens will continue taking advantage of its government’s policies.