These changes will comprise the inclusion and replacement of certain items and services not initially covered by the Act. Choiseul/Saltibus Parliamentary Representative, Bradly Felix, takes issue with the maintenance and repair of motor vehicles amendment in particular. He says the Pierre Administration should reconsider this decision due to the current conditions of roads on the island.

The Order Paper for the August 8th sitting of Parliament states, “In the case of Schedule 2, include maintenance and repair of motor vehicles as a service that requires payment of the health and citizen security levy.”

“When you look at the condition of the roads currently, particularly with the heavy rains. The damage that has been done to the bus drivers and private vehicles, and most times people face very expensive vehicle parts. Some consideration should be given, until the roads are repaired, to this.”, the Choiseul MP explained.

The amendments will also “include [vinegar, quicklime, slaked lime, white cement and other hygienic or pharmaceutic articles]” as exempted goods. Additionally, “goods on medical equipment, goods on security and surveillance equipment” will be exempted from the 2.5% levy.

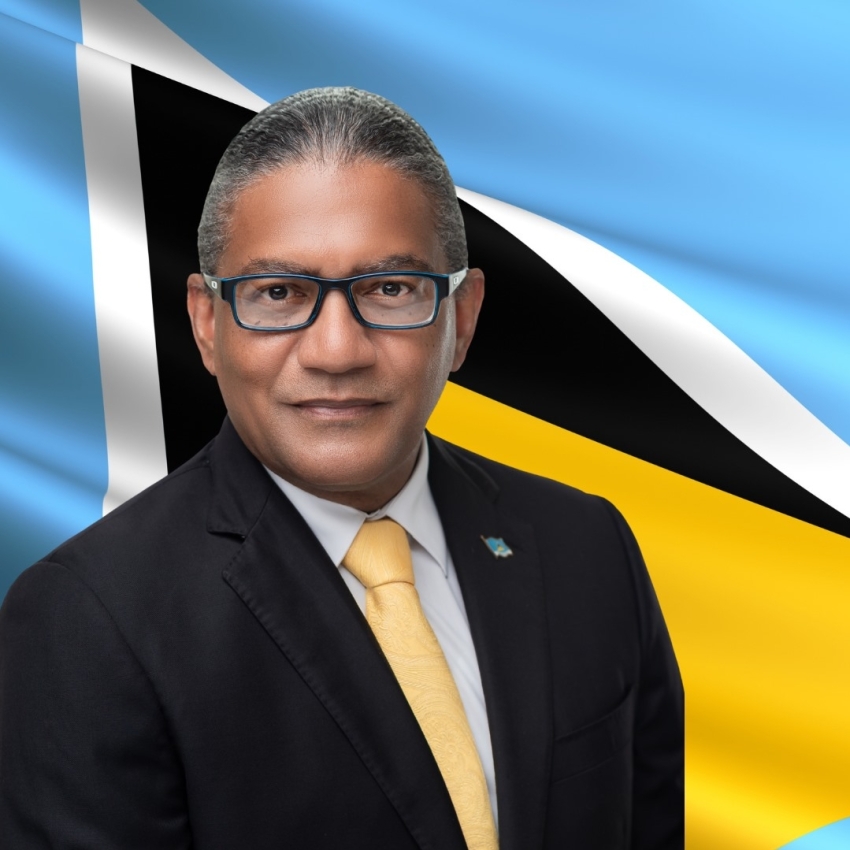

Prime Minister, Honourable Philip J. Pierre, however, explains the amendments to the Act. He says after the government conducted a review of exempted goods, it was discovered that some items were not accounted for.

“There were some goods where they were under the classifications of building materials, but they were not on the exempt list. So, in the review, we found that we had to make these changes.”, the Prime Minister explained. “We are making these adjustments to ensure that the removal of V.A.T on all building materials.”

The Prime Minister also clarifies that the manufacturing industry will not pay the 2.5% levy on their packaging materials. “The manufacturing sector will not pay health and security levy on their raw materials once it is certified by the Ministry of Commerce.”, Pierre explained.

According to the Prime Minister, the Act will continue being revised to ensure all exemptions are included.