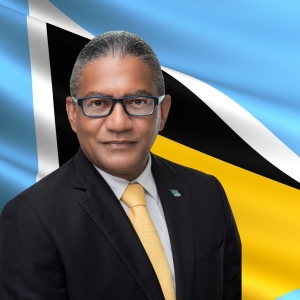

The Prime Minister says following consultation with the private sector, an agreed date for the imposition of the levy on services is October 1st, 2023.

“2.5% is not being applied to services at this point. Businesses have the time to update their software and so on”, the Prime Minister explained. This, he says, allows businesses the time to effectively implement accurate measures of the levy. As for goods, the Prime Minister says, the levy will be charged at the ports, not at points of sale, like supermarkets.

Pierre also doubled-down on statements that he made earlier, stressing that “old stock and new stock” do not exist. He says zero-rated items like building supplies were not to be sold with any VAT imposed from August 2nd, 2023. “The zero-rated items are effective immediately, there is no old stock or new stock”.

Citizens have used the argument of old and new stock as a means to explain what appears to be price gouging in stores. Consumers have complained of increases in prices for some items which are supposed to be zero-rated. The Consumer Affairs Department, however, will be monitoring the prices island-wide to prevent such an occurrence from happening and has operationalised a hotline to report any such complaints 468-4239, 468-4232, 468-4226, or 468-4224 or This email address is being protected from spambots. You need JavaScript enabled to view it.. To this end, the Prime Minister has asked for the cooperation of the private sector in the implementation of the health and citizen security levy.